Bouncing of Cheque under Negotiable Instrument Act

Transactions through banks have become really common these days. There have been a lot of steps taken by the government to encourage people to rely more on bank-based transactions. This lead to most of the business owners to avoid transactions using direct cash, instead bank based transaction by use of cheques and online methods are popular these days. This gives total transparency to transactions and avoids fraud currency and money laundering to a higher extent. But Bouncing cheques are still a headache in this case for many people. But bounced cheque can be easily handled today without any hustle if you have cheque bounce cases experts like AK Tiwari and Associates who have a team of experienced lawyer for a cheque bounce case to back you up. We are best Lawyers for Cheque Bounce Cases in Noida and Ghaziabad, Uttar Pradesh.

Cheques are a document that will be ordering the bank by the account holder to provide a fixed amount of money to a person who the cheque is entitled to use. This is used for a wide variety of purposes from the re-payment of loans to bill payments. Cheques are part of bank transactions for a very long time now and are still used as a reliable way to do payments by a lot of people. The reason why cheques are widely used is they can be used as good proof of payment. All banks clear a lot of cheques on a daily basis. But the biggest problem which existed since cheques came into existence is the bouncing of cheques. But the solution is not that hard if you approach the case with the help of some good lawyers for cheque bounce case or preferable a professional law firm like AK Tiwari and Associates.

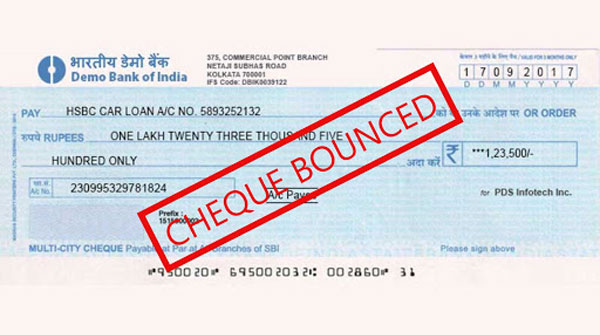

What are bounced cheques?So a cheque lets the person get a fixed amount from the account holder’s account balance. But in some cases, the cheque won’t get processed and this is called bouncing of cheques. The main reason why these cheques end up being unable to process is that the account holder does not have enough balance to clear the amount mentioned in the cheque. Providing such cheques is illegal and you can deal it with the help of lawyers for bounced check case. There are special acts to deal with such cases legally. You can get a clear idea of your specific case from some law firm like AKTiwari and Associates; they use the service of experienced lawyers for a cheque bounce case and can provide you with all legal support.

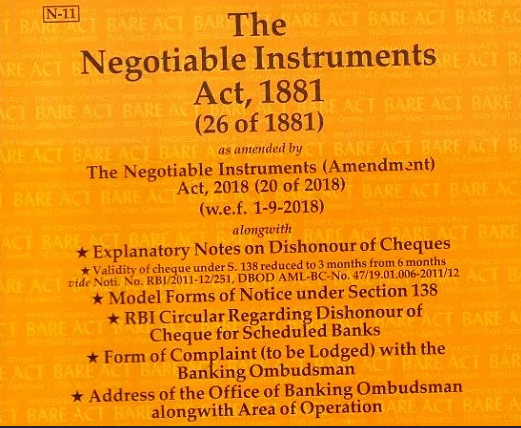

Acts to deal with cheque bounce casesLawyers for cheque bounce case can mainly help you by the use of Negotiable Instruments act, 1881. There have been a lot of amendments made to this act from the came it is enforced. The act considers bounced check as a criminal offense and can lead to penalty, imprisonment or both. Once the check is bounced a chance to repay the amount immediately is given first. If the account holder doesn’t clear this then you can avail the service of some lawyers for cheque bounce case.

Negotiable Instruments Act, 1881

Cases of cheque bounce are not uncommon these days. In most of the transactions be it re-payment of loan or payment of fees for business purpose, payments are made by cheque. These cheques bearing large amounts sometimes remain unpaid and are returned by the bank on which they are drawn. For such cases punishment is provided by Section 138 of Negotiable Instruments Act, 1881 (hereinafter the Act). Offence of dishonour of cheque as mentioned u/s. 138 of the Act is considered as a criminal offence.

Section 138 says: Dishonour of cheque for insufficiency, etc., of funds in the accountWhere any cheque drawn by a person on an account maintained by him with a banker for payment of any amount of money to another person from out of that account for the discharge, in whole or in part, of any debt or other liability, is returned by the bank unpaid, either because of the amount of money standing to the credit of that account is insufficient to honour the cheque or that it exceeds the amount arranged to be paid from that account by an agreement made with that bank, such person shall be deemed to have committed an offence and shall, without prejudice to any other provision of this Act, be punished with imprisonment for a term which may extend to one year, or with fine which may extend to twice the amount of the cheque, or with both.

Cheque Dishonor -NIA Act U/s 138 - When a person issues a cheque for his / her liabilities and the same cheque accepted by another Person & deposited in their bank account for clearance but cheque not cleared due to the reason of insufficient Fund, Payment stop, Account closed whatsoever its called cheque dishonor, Cheque Bounce.

Steps for filing Cheque Bounce case

Negotiable Instruments Act Section 138 which comes under the cheque bounce case clearly states that if an offence is committed then it can lead to criminal activity. However if you are facing a cheque bounce issue then you would be definitely requiring a cheque bounce lawyer in Noida and this is required for clients to serve a legal notice to the opposing party.

Bouncing of cheque is one of the criminal offences in India and this is being taken very seriously. There are cases when you can even file a civil suit in order to recover the cheque amount along with the cost the person owes including the interest amount. The mandatory procedure a client needs to undergo the case of cheque bounce offence under the section 138 of the Act it needs to have the cheque drawn on an account which is maintained by a person who owes the money. The cheque should be presented within a period of three months.

Step 1: Send Legal Notice-As per the provisions of Negotiable Instruments Act, Section 138 you must send a legal notice to the Defaulter whose Cheque has been Dishonoured. A legal notice has to be sent to the defaulter within 15 days of Dishonour of Cheque by Registered Post A.D.

Step 2: Legal Notice Details important (sent by the Payee/Receiver of the debt or money)- must be drafted by a Best Lawyer For Cheque Bouncing Cases In Fort, Mumbai and Maharashtra and contain all the facts of the case including the nature of transaction, Amount of Loan or any other legally enforceable debt for the satisfaction of which the cheque was issued, Date of Deposit in Bank, Date of Dishonour of cheque.

Step 3: 15 days grace period provided to Drawer- The Drawer (Person who has to pay off debt) has to make payment for the debt owed to the payee within 15 days of service of notice.

Step 4: When debt is paid-off within 15 days of service of notice the matter is done away with- Hence law provides for this 15 days grace period to delay any further legal action and to provide a second chance to the Drawer of the cheque to fully and properly pay the legally enforceable debt or loan to the payee.

Step 5: Payment not made within 15 days- The person who has been denied rightful debt payment for the reasons of the account not having sufficient funds etc, can now file a complaint in the form of a CRIMINAL CASE in the court of lowest jurisdiction.

Step 6: 30 days crucial time period provided to the complainant to file the criminal case- 30 days are calculated from the expiry of the Notice Period of 15 days given to the Drawer of the cheque to repay the debt.

Step 7: Court issues process- Upon registering a complaint case, the matter gets listed in the Courts in due time. The Magistrate hears the arguments of the Complainant and issues the required process.

AK Tiwari and Associates is one of the Best Lawyer For Cheque Bouncing Cases in Noida, Uttar Pradesh.